What is Greenwashing

With growing public awareness, societal pressure, and policy measures addressing climate change, businesses are increasingly required to disclose their climate-related financial information, not only as a legal obligation but also as part of their business strategy to attract investors and customers. While some businesses genuinely commit to environmental responsibility and make honest climate disclosures, many choose to engage in practices to appear more environmentally sustainable than they truly are. Such practice is widely known as “greenwashing”, where businesses make false, misleading, or exaggerated environmental claims about their operations, products, or services.

Australian regulatory bodies, such as ASIC and ACCC, are actively working to prevent and penalise such practices. While intentionally making misleading, false, or exaggerated environmental claims fall within the ambit of greenwashing, intention is not always a determinative factor. A business can be found to be liable for greenwashing practices even if it did not intend to provide misleading environmental information. For instance, making an environmental claim without reasonably believing the authenticity of that claim, albeit without having the intention to mislead, can also be categorised as greenwashing.

Penalties for greenwashing

Penalties for greenwashing can be as high as $2.5 million per contravention. Vanguard Investments Australia has recently been imposed a penalty of $12.9 million by the Federal Court due to its greenwashing conduct. Furthermore, the mandatory climate reporting also extends liability for greenwashing on directors in their personal capacity.

With reputational risks and potentially high penalties at stake, it is important for businesses to take precautions and conduct thorough due diligence in their climate reporting to ensure transparency, accuracy, and to avoid indulging in greenwashing practices. Climate reporting can be complex, and to avoid legal actions for inaccurate reporting (greenwashing), it is vital for businesses to understand the concept of greenwashing, its types, and what courts and regulatory bodies suggest about greenwashing cases.

Types of Greenwashing

There are different ways in which businesses can engage in greenwashing. Following non-exhaustive list provides common greenwashing tactics:

- Using highly ambiguous or vague environmental claims;

- Making claims that are not backed by supporting evidence;

- Cherry-picking specific positive environmental aspects while choosing to not disclose its larger negative impacts;

- Using misleading labels; and

- Committing to GHG reduction targets or climate transition plans without having an actionable strategy.

ACCC’s/ASIC’s crackdown of Greenwashing

ACCC and ASIC have taken legal action against businesses for misleading environmental claims. Understanding the rationale established in these cases can be a useful guide addressing greenwashing practices. Notable cases include:

- Clorox Case:

Clorox was found to be engaging in greenwashing practices for claiming its garbage bags to be a significant amount of ocean plastic, when the percentage was much lower. This is a clear example of intentionally exaggeration of environmental claims to mislead stakeholders.

- Mercer Case:

Mercer Superannuation had claimed that its “Sustainable Plus” investment options excluded certain environmentally harmful industries, such as thermal coal industry. In fact, it was found not to exclude those environmentally harmful industries as it claimed. Mercer was fined $11.3 million. An example of providing false environmental claims.

- Vanguard Case:

Vanguard Investments Australia was found to have been making false representations regarding the environmental screening it applied to its “Ethically Conscious Global Aggregate Bond Index Fund,” leading to a significant penalty. This is a case of using misleading labels to attract customers and investors.

- Santos Case – first ever Greenwashing claim on climate-related targets:

While the case remains sub judice, it highlights the broad scope of cases that can be classified as greenwashing. Santos is being sued by the ACCR on the grounds that it allegedly misled its investors by claiming to have a clear plan to reach net-zero emissions by 2040 while continuing to expand its fossil fuel operations – an example of highly ambitious environmental claims without an actionable strategy.

These cases are an example of how exposed businesses are to legal action on greenwashing, now that it is mandatory for businesses to report their climate disclosures. With mandatory disclosure requirements such as climate transition plans and GHG reduction targets, businesses can be sued for allegedly misleading the public in their attempt to remain compliant with unprecedented mandatory reporting mechanisms.

How to avoid greenwashing – ACCC guideline

ACCC has issued a guide for businesses to potentially avoid greenwashing, the guide can be summarised as follows:

- Make truthful and accurate claims;

- Have evidence to support your claims;

- Do not hide material information;

- Explain any conditions on claims;

- Avoid vague claims;

- Be clear and easy to understand;

- Avoid images, labels, or visuals that may be misleading; and

- Be open and direct about sustainability transition.

How can Verimus/ClearESG/CC help you?

With the introduction of unprecedented mandatory reporting, businesses are required to report various aspects of climate-related financial disclosures. While being compliant with the mandatory reporting can be extremely complicated, it can be even more complex to avoid legal action on greenwashing emanating from climate disclosures.

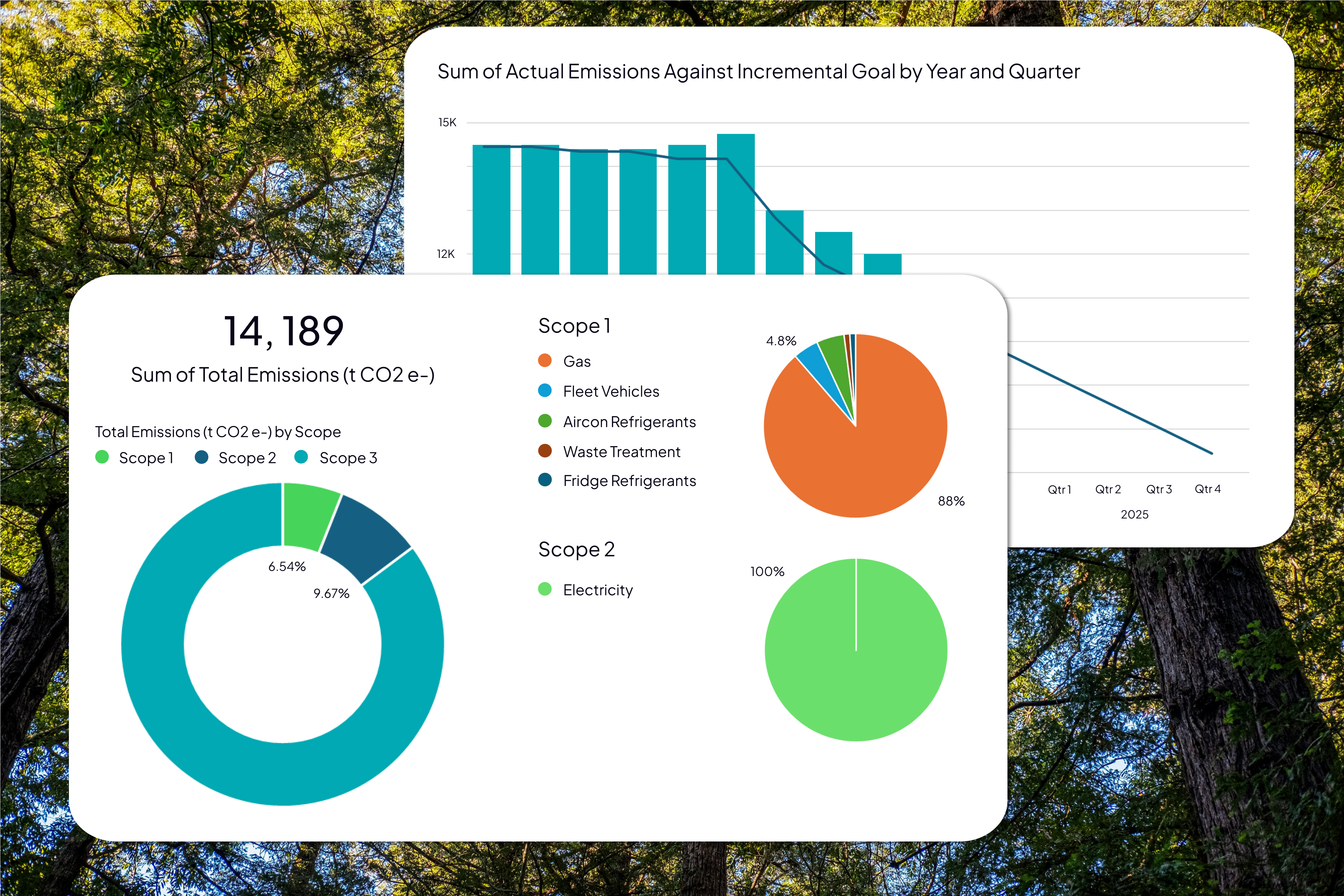

Verimus is one of the leading firms with extensive expertise in (E)SG reporting and climate disclosures. Supported by advanced digital software and tools, Verimus helps you comply with complex legal frameworks accurately and efficiently, while making sure you gain long-term resilience and competitive advantage in the industry.

Verimus partners with Cowell Clarke so your business can benefit from free legal advice anytime you feel lost in the complex legal requirements. As digital solutions experts specialising in the field of (E)SG, Verimus is here to help you navigate smoothly through the complex intricacies of mandatory climate reporting, helping you stay protected from any legal action.